Investing has never been simpler… or smarter

Since 2014, we’ve made investing simple, using ETF models to build smarter portfolios with better returns and less risk.

Our Performances

This figure reflects what you would actually have earned if you had invested with myETFmodel (excluding taxes).

Annualized performance from 06/11/2014 to 09/30/2025 - Benchmark: +8.8%

How it works

Our investment models continuously adjust their exposure to help limit risks and protect your portfolio in today’s volatile markets.

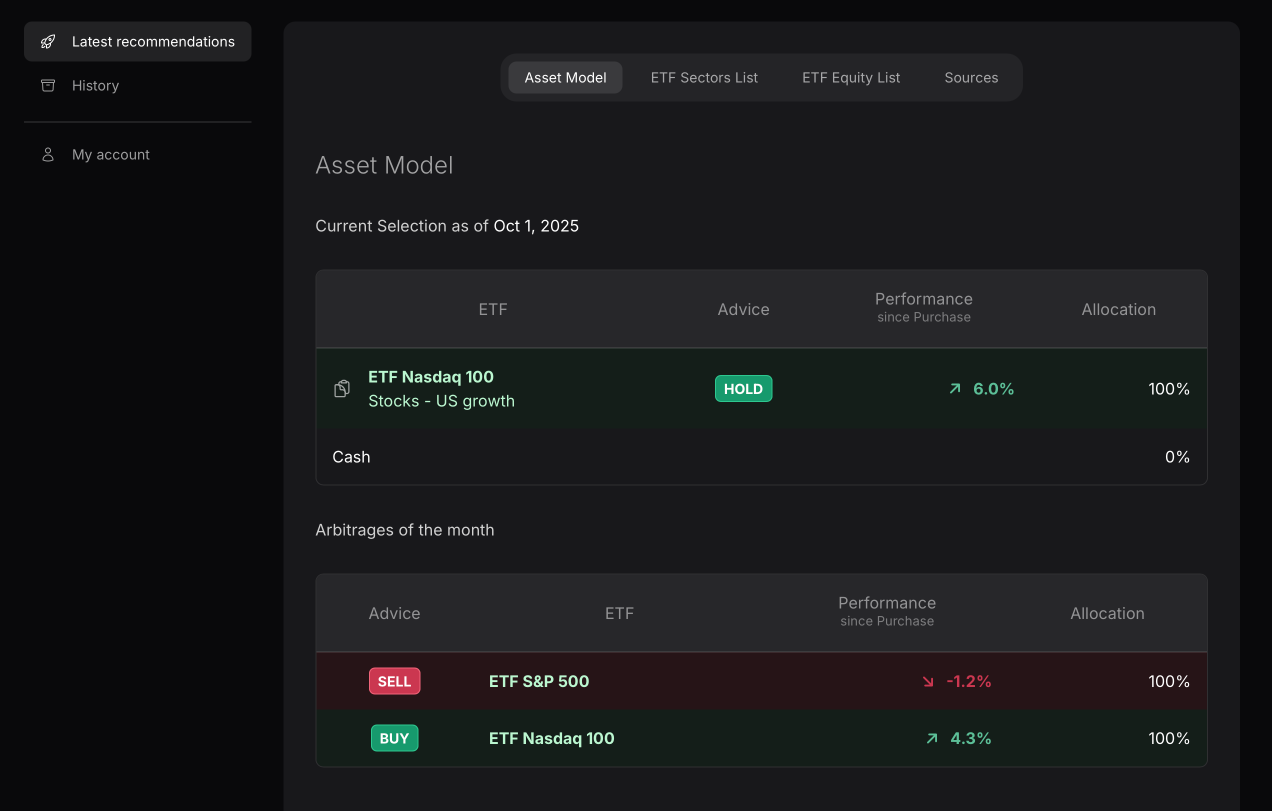

1. Access the latest recommendations

Our Investment Model Recommendations are just a few clicks away. Sign up to one our plans and get instant access to our latest guidance.

2. Update your investments

Whether you invest through a non taxable account or your own personal accounts, we'll show you exactly how to update your allocations.

3. Adjust your holdings each month

Our models continuously adjust to evolving market conditions to help protect and grow your capital. Stay aligned with our updated recommendations to keep your allocations on track.

Spend less time worrying about your investments

Get recommendations based on the profile you provide. Extract from your dashboard instantly.

Get concise and actionable recommendations for your investments, simply copy and paste the ETF Symbol or Name into your broker.

Our Key Features

Frequently Asked Questions

Main questions here and more hereafter.

ETFs offer lower fees, greater transparency, and intraday trading flexibility. They’re an efficient way to diversify your portfolio across global markets and asset classes.

We charge a transparent subscription fee, with no hidden commissions or product markups. ETFs themselves typically have very low expense ratios, keeping overall costs minimal.

Each ETF is selected to capture a defined market segment, such as U.S. growth stocks, European large caps, or bonds, or a particular sector like technology or healthcare. The final choice of which ETF to invest in is determined through a data-driven screening process that evaluates multiple momentum indicators.

No.

myETFmodel (SixEight SAS) is an independent research company.

We provide model-based recommendations and educational content.

We are not a bank, broker, or financial advisor, and we do not receive any commissions from ETF providers.

Your investment decisions remain under your responsibility.

Portfolios are reviewed monthly to maintain target allocations and risk levels.

On average, we typically make three to four trades per year.

This monthly rhythm filters out market noise and keeps the process simple, requiring only a few reallocations per year.

Invest smarter, save more.

Pick a 1, 2, or 3-year plan—the longer you commit, the less you pay per year, with the 3-year option offering the best value.